Who Should Attend?

- Angel investors, venture financiers and corporate finance advisors

- Financial Intermediaries and institutions

- Investors and business owners

- Chambers of Commerce and Associations

- Accountants and Lawyers involving in Private Equity industry

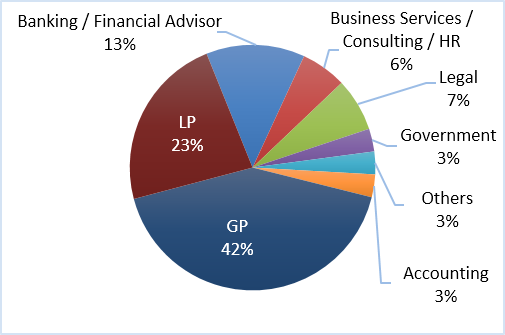

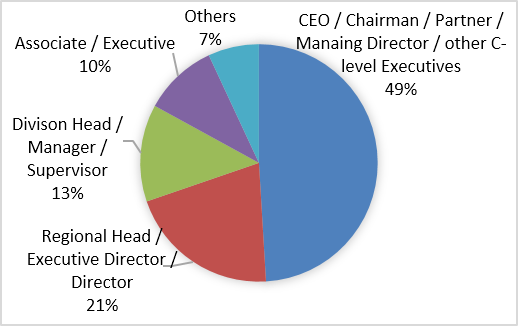

Delegate Analysis

HKVCA APEF 2023 Highlights